Make or Break for Hydrogen Mobility – Introduction to a whitepaper article series.

Without a doubt, one of the key challenges of our time is slowing down climate change drastically with the designated goal to cut CO2 emissions by over 80% until 2050. Regarding current transportation being one major driver of greenhouse gases. The need for a zero-emission solution across all types of vehicles becomes most evident. In the light of the above the potential of hydrogen, if produced by renewable energy sources, as an alternative fuel is enormous. Yet the future of H2 mobility can be defined by a perfect storm of uncertainty.

In order to unfold its full potential,turn into a sustainable alternative for Internal Combustion Engine Vehicle (ICEV) and stay competitive with Battery Electric Vehicles (BEVs , every intersection of the H2 mobility value chain reveals a need for new build, optimization or cost reduction, from primary source energy production to the Fuel Cell Electric Vehicle (FCEV) fleet itself.

In the three parts of this article-series we are breaking down a complex question and give insights on how to reach the global stage with a technology still considered a niche:

Part 1: The window of opportunity for hydrogen mobility.

Part 2: Infrastructure holds the key.

Part 3: From best practice to the global stage.

Part 1: The window of opportunity for hydrogen mobility

In 2017, sales of BEVs in the EU climbed 54% to 97,571 vehicles. This equated to a market penetration of 0.7% of total vehicle sales. This number hovered at around 4,600 vehicles sold only just six years earlier. In 2011 – a number on par with global sales of all FCEVs in 2017.

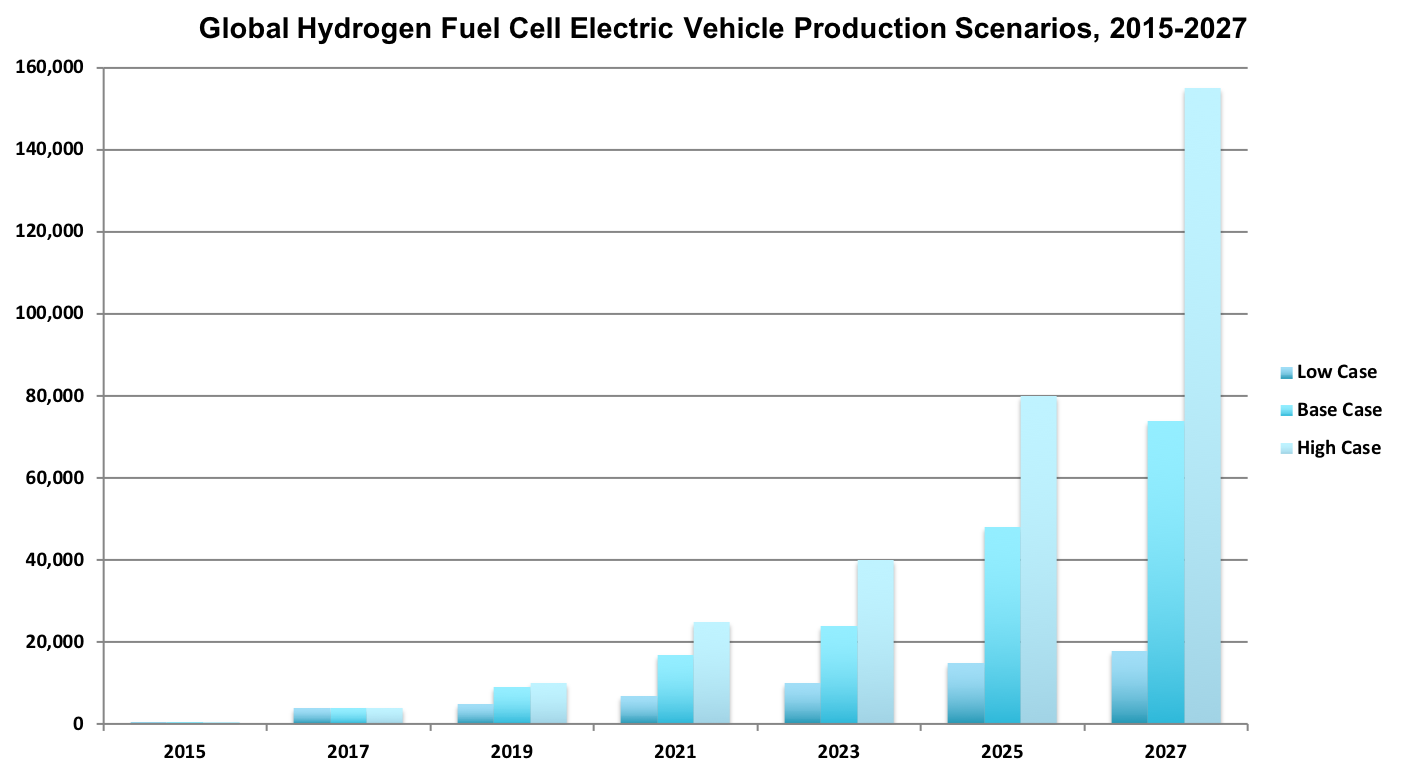

Global FCEV production is expected to reach comparable figures to current EU BEV figures by the end of the next decade. 14 Original Equipment Manufacturers (OEMs) are expected to be producing 17 vehicle models. Which are forecasted to exceed 100,000 units produced annually by 2028.

In spite of this outlook, a number of issues are still creating significant uncertainty with regards to the full-fledged emergence of the H2 mobility sector, and its capability of creating analogous growth to the now self-sustaining BEV segment.

Influences on future FCEV production scenarios:

The projected production figures in the base and high case scenarios rely on a combination of factors currently opening a window of opportunity for H2 mobility. The key inputs opening this window are committed policy support, technological specifications advantages vs. alternative options as well as maturation and drop in costs of key technologies.

In spite of these favorable inputs, the FCEV window of opportunity faces a limited horizon and should, as a result, be seen as a ‘make or break’ window.

However, a number of threats to the sector’s emergence could still lead to a low case scenario characterized by a failure to seize the current opportunity. If, for example, battery technology can reach identical charging time and ‘well to wheels’ emission levels prior to sufficient self-sustaining, commercial market penetration on the part of FCEVs, fuel cell technology is at severe risk of being deemed a niche technology once and for all. Effectively, FCEVs would risk being relegated to public utility, medium and heavy-duty vehicle type use cases.

Further, as battery energy density increases and cost per kilowatt-hour continues to decrease, e-mobility could reach a sweet spot in charging time, cost and range, that has the potential to outweigh the cost-benefit implications of commercial H2 mobility deployment.

As the case of California suggests, there is space in the market for BEV and FCEV complementarity, considering their advantageous zero tailpipe emissions footprint compared to hybrid and existing ICEV technology. However, the latecomer status coupled with the 2017 commercial ‘arrival’ of BEVs emphasizes the current window as mission critical for FCEV evolution.

Policy decisions are now accelerating deployment

As such, in these early days of market maturity, policy intervention in particular has the potential to drastically accelerate either the ‘make’ or the ‘break’ scenario for H2 mobility. At the global level, the 2017 formation of the Hydrogen Council has meant setting ambitious FCEV targets for the medium and long term such as 400,000 commercial trucks and buses as well as 1 in 12 cars sold in California, Germany, Japan and South Korea by 2030. This is taking place in response to decarbonisation targets ranging from the EU’s longstanding climate targets to the more recent Paris Accord and innovative urban initiatives such as the C40 Fossil-Fuel-Free Streets declaration.

At a more local level, individual regions such as California and Norway are the prime example of how providing enough support in the form of generous tax breaks or toll exemptions can lead to a sales penetration of over 20% of all vehicles by BEVs, as it was the case in 2017 in Norway.

Although automaker powerhouse nations like Germany are considering similar policy moves, Germany is notably slower to move, as with electric vehicle uptake previously. Despite being a large-scale energy transition innovator, disrupting its own vehicle producing industry is a policy tightrope act not yet mastered.

In the meantime, countries with less OEM dependence in the traditional automotive market and with national household energy players that stand to benefit from a transition to low-emission vehicles as part of a wider hydrogen or low-emissions economy, are poised to play an important role in creating early adopter demand. No less, these markets are already showing signs of becoming crucial in creating FCEV export markets for early OEM movers.

Infrastructure is putting the brakes on this opportunity

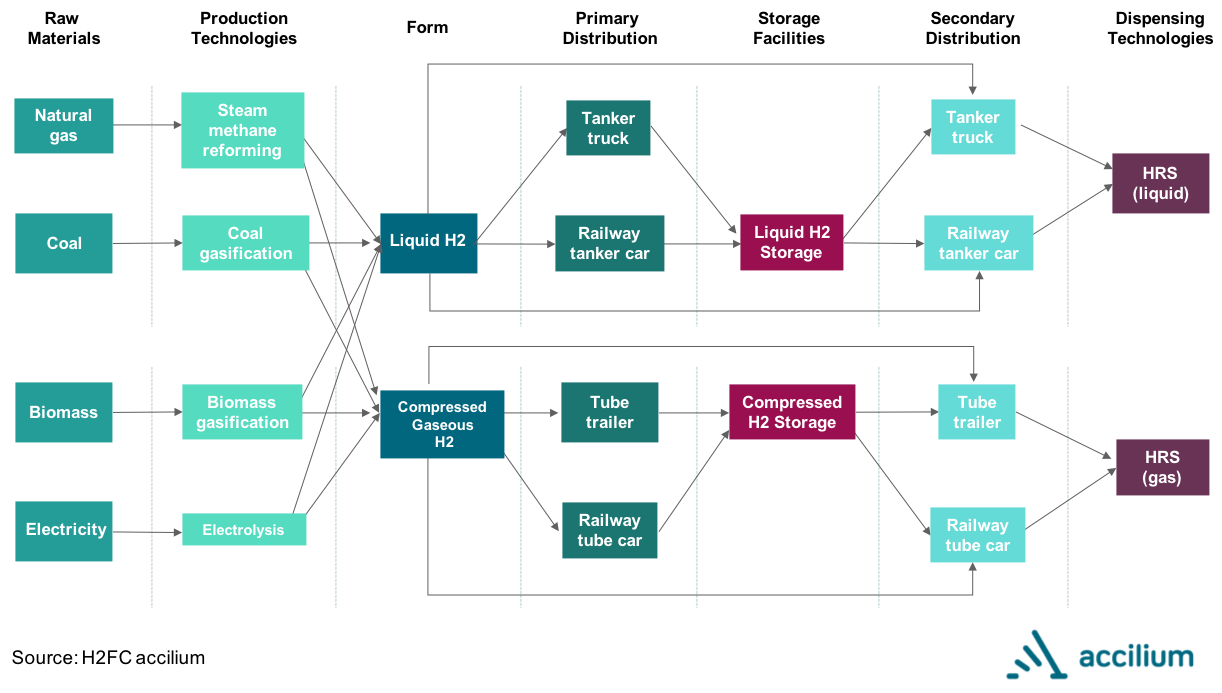

Even though policies can have a mayor impact on the deployment of hydrogen mobility, the infrastructure currently acts as a bottleneck for that deployment. From production to dispensing facilities, the infrastructure reveals weaknesses at every juncture, ranging from technical and systemic inefficiencies to incompatibility with existing networks, high CAPEX requirements as well as high-risk business models revealing cash gaps on investment returns.

In the next article, “Part 2: Infrastructure holds the key”, we will discuss those infrastructure related difficulties, how to tackle the H2 mobility network pathways in a way where they can lead to successful business models and how a closer look on the value chain reveals new opportunities for H2 mobility.

Go to article Part 2: Infrastructure holds the key

Go to article Part 3: From best practice to the global stage

ISO/IEC 27001:2013 certified

ISO/IEC 27001:2013 certified