The magnitude of Europe’s industrial policy shift is not easily graspable. This new direction represents a €800+ billion investment surge through 2030 that will fundamentally transform manufacturing value chains. For the automotive industry, this creates a rare strategic inflection point where defence sector pivots, supply chain sovereignty, and legal requirements for decarbonization converge to create both existential threats and generational opportunities for OEMs and suppliers alike.

The New European Industrial Strategy: Scale and Scope

The EU’s approach to industrial competitiveness is a cross-industry and cross-border coordinated effort to fundamentally reshape manufacturing capabilities across Europe. The Metals and Steel Action Plan and ReArm Europe alone will mobilize unprecedented investments exceeding €800 billion by 2029. This includes the Security and Action for Europe (SAFE) instrument providing €150 billion in loans for critical defence projects and coordinated activation of the National Escape Clause allowing defence expenditure up to 1.5% of GDP for European Member States. This massive capital reallocation will reshape manufacturing capacity and innovation priorities across EU economies, creating both competitive threats and strategic opportunities for automotive players.

The Automotive Crisis

The automotive sector stands at a critical inflection point. The Draghi Report on EU competitiveness (2024) explicitly highlights that there are “competitive gaps, both concerning cost and technology” in the EU automotive supply chain. This insight arrives as the industry faces a triple transition challenge: electrification, software-defined vehicles, and shifting global demand patterns.

Of central importance is the fact that European automotive players employ a highly-skilled workforce of 5 million with economic multiplier effects that create 3 additional jobs in the direct supply chain and 3-5 more in the wider economy for every vehicle manufacturing position. However, the sector is under pressure, with roughly 86,000 jobs lost since 2020, with Germany being hit the hardest (52,000 jobs lost).

Opportunities

The European industrial strategy reorientation presents automotive OEMs and suppliers with three critical strategic areas to analyse and act upon: diversification, regionalization and decarbonisation.

1. Defence Diversification: The €150 Billion Opportunity

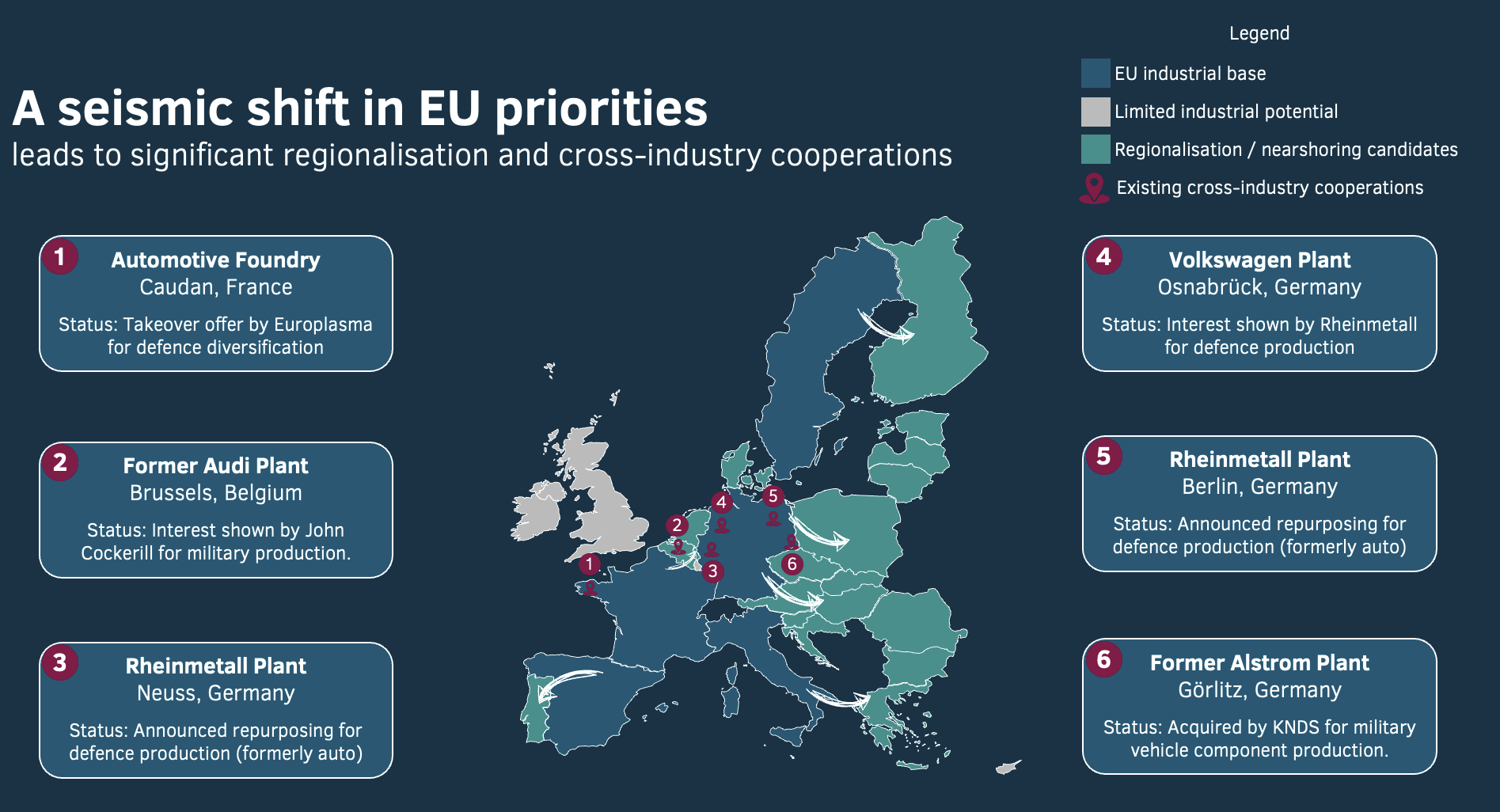

The ReArm Europe initiative creates immediate adjacent market opportunities for automotive players. Defence sector expansion is targeting seven priority capability areas with significant technology overlap with automotive competencies, particularly in electronics, AI, and advanced materials.

Rheinmetall and Continental have already began following this approach, signing an MOU to facilitate the retraining of auto workers affected by industry transformation.

Europlasma’s bid to convert a former Renault foundry into a producer of mortar shell casings signals the beginning of a broader trend of production line repurposing that could accelerate across the continent, pending a steady supply of defence production demand that will continue well into the end of the current decade.

Automotive suppliers should assess their capabilities against defence sector needs to identify diversification opportunities before competition intensifies.

Companies with expertise in advanced electronics, lightweight materials, and autonomous systems have particularly transferable competencies.

This diversification brings multiple strategic benefits:

Counter-cyclical revenue streams to offset automotive market volatility;

Access to premium-priced defence contracts with long-term stability;

Opportunity to retain skilled workforce during automotive industry restructuring;

Potential to leverage dual-use technology development.

2. Supply Chain Regionalization: By Europe, For Europe

As the EU is moving aggressively to secure strategic autonomy across critical supply chains, automotive players find themselves in both an opportunity and an imperative to regionalize value chains.

European automotive production networks are already deeply integrated in the EU Single Market: approximately 22% of the value added in French-made cars and 14% in German vehicles comes from inputs generated in other EU countries.

The EU’s push for more autonomy in materials creates opportunities for automotive OEMs to secure competitive advantage through vertical integration, a practice which was successfully implemented by the European automotive industry in the past and which can again be leveraged to secure future competitiveness. Indeed, Commission is allocating €1.8 billion specifically to develop secure supply chains for battery raw materials.

Furthermore, decarbonization can be achieved already at supply chain-level. Steel accounts for a remarkable 27% of production emissions for internal combustion engine cars and 15% for battery electric vehicles. Current emissions intensity of automotive steel in Europe exceeds 2.0 t CO₂e per tonne – 50% higher than the European steel industry average of 1.4 t CO₂e/t.

A plethora of opportunities are available for automotive players looking to regionalize:

Strategic investments in European primary materials production, in particular nearshoring opportunities to achieve strong price competitiveness.

Development of closed-loops recycling systems for critical materials.

Material substitution R&D.

Cross-industry consortia that aggregate demand to enable European production scale, so as to achieve the required production output.

Conclusion

A historic strategic opportunity emerges for European automotive players from the continent’s €800 billion industrial renaissance, offering a pathway through current market headwinds towards long-term competitive advantage.

Yet, seizing this demands profound transformation and confronting challenges that require careful navigation. Key obstacles include understanding and meeting disparate sector-specific demands (such as Defence versus traditional automotive), effectively scaling operations and reshaping the workforce while preserving organisational stability and talent, and realistically evaluating the depth of existing skills. Critically, companies must also look inward, challenging the inertia and legacy thinking that may exacerbate current crises.

Ultimately, the ability to navigate these complexities through decisive action in the near term will define leadership in Europe’s industrial future post-2030. Those unable to adapt face diminishing relevance in a rapidly changing landscape.

Stefan Cibulka-Rothauer

Manager

Ann-Kristin Gross

Associate Manager

Cristian-Marian Bololoi

Senior Associate

ISO/IEC 27001:2013 certified

ISO/IEC 27001:2013 certified