Make or Break for hydrogen mobility: From best practice to the global stage (Part 3)

Looking back at the first two articles of this series, we have learned about the major impact of policies on the deployment of hydrogen mobility as well as the infrastructure acting as a bottleneck for that deployment. A close look at the value chain has shown that with efficiency improvements the FCEV cost barriers can be a thing from the past but still Hydrogen Refuelling Station (HRS) sits at the top of the list of issues hampering H2 mobility expansion.

In the third and last article of this series, we take a closer look at HRS requirements and present California’s approach on the infrastructural hurdle – an example with the potential to be introduced as blue print for the global stage.

A closer look at the Hydrogen Refuelling Station (HRS) requirements:

In spite of the multitude of infrastructural shortcomings and obstacles outlined, inefficiencies and high costs can be readily optimized. However, the nearly complete absence of a component as crucial as HRSs sits at the top of the list of issues hampering H2 mobility expansion.

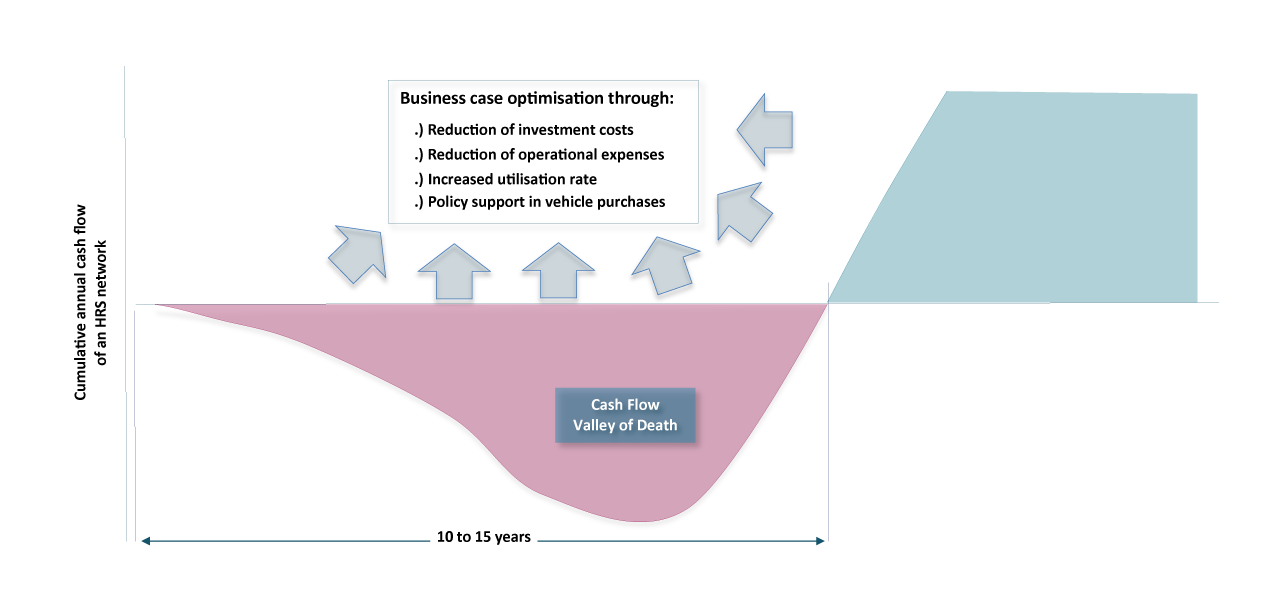

Considering this compounded scenario, the H2 mobility segment is revealed to be facing a ‘chicken and egg’ dilemma. The sector needs to build out infrastructure without a clear picture of the level of demand for it and, moreover, facing the additional challenge of how to map this demand uncertainty geographically in order to understand its effect on the required network density.

This, once more, emphasizes the need for a high degree of state entrepreneurship alongside innovative and stable policy targets and public-private partnerships in order to break the vicious cycle of unguided under-investment.

As a benchmark, the existing US fleet of about 240 million gasoline-fuelled light-duty vehicles (LDVs) is served by a network of around 120,000 – 150,000 retail gasoline-refuelling stations. This equates to roughly 2,000 gasoline vehicles for every gasoline station. By comparison, at the end of 2016, 33 retail HRSs served approximately 1,000 FCEVs in the United States, 30 FCEVs per station.

HRS Business Case Risk

Considering that a 100 kg per day station would be enough to refill a fleet of around 200 FCEVs over the year and considering the average station capacity in California of 195 kg per day (able to service 390 FCEVs over the year), the currently planned HRS build out of 131 stations in California should be able to support a fleet size of around 51,090 given appropriate network density.

A theoretical scenario looking to replace 30% of gasoline-fuelled LDVs with FCEVs by 2050 at current HRS output levels and cost would amount to $369 billion of required investment in HRSs. However, with expected drops in HRS investment requirements to under $1 million per station and output increases of up to 350 kg per day already a reality, a total requirement of $98 billion over the course of the upcoming 32 years – or $3.1 billion annually, on average – is a closer theoretical possibility.

How California is jumping the infrastructural hurdle:

There are currently only three commercial FCEV manufacturers of which two are Japanese and one is Korean. And yet, over 50% of all global FCEV sales to date are attributable to California, which is the world’s leading market for FCEVs as a result of a combination of key factors. Push and pull policies to stimulate the market, public-private partnerships and a large, technologically friendly manufacturer and consumer base have advanced this regional market to the position of global leader.

Policy innovation for advanced vehicle standards began with legislation such as the Zero Emissions Vehicle (ZEV) mandate in the 1990s. More recently, in 2013, Assembly Bill 8 was signed into law, providing $20 million per year just towards HRSs as well as annually revised and updated recommendations for the deployment of FCEVs and HRSs.

Also in 2013, California provided longer-term incentives and growth perspective by signing an MoU with seven additional states to pursue a multi-state Action Plan. The aim of is to deploy 3.3 million ZEVs by 2025 in California, Connecticut, Maryland, Massachusetts, New York, Oregon, Rhode Island, and Vermont.

California HRS Locations and Select Developer Activity Overview

Financial support mechanisms provided include O&M grants and direct capital subsidies such as the Clean Vehicle Rebate Program. This offers California residents up to $7,000 for the purchase or lease of a new, eligible zero-emission or plug-in hybrid light-duty vehicle. 25%–30% of all new vehicles sold in the United States are subject to ZEV regulation (CARB 2017).

As a result, OEMs have an intrinsic business reason to help promote and advance ZEV infrastructure, for both BEVs and FCEVs. This is exemplified in public-private joint ventures such as Toyota and Shell partnering with the California Energy Commission (CEC) to install HRSs.

The CEC is contributing $16.4 million compared to Toyota’s and Shell’s joint $11.4 million for a dedicated build-out to support commercial rollout of Toyota’s Mirai model over the coming years. In addition, automakers are offering FCEV customers the opportunity to cover fuel costs for up to three years upon purchase of an FCEV to help shield consumers from fuel costs until expected drops in pricing take hold.

This continuous virtuous cycle of support has led to 31 public HRSs that are already active with a further 100 in various planning stages across California, with a focus on urban centers. Over 30 of these were already under construction in 2016.

Taking California’s example to the global stage:

Key markets following suit that are likely to catch up and even surpass California’s current state of play are Japan and China. China recently announced its ‘Shanghai Fuel Cell Vehicle Development Plan’, which has the potential to position China at the forefront of the H2 mobility market.

The plan calls for $15 billion in annual fuel cell value chain output, including annual production of at least 20,000 FCEV passenger vehicles and 10,000 FCEV commercial vehicles. Japan, meanwhile, outlined its ‘Strategic Road Map for Hydrogen and Fuel Cells’ report in 2016.

The strategy calls for 160 HRSs and 40,000 FCEVs by 2020, in time for the Tokyo Olympics. Germany, although lagging in implementation at OEM level to date, is very much at the fore of European FCEV build-out planning. The currently 50 operational HRSs are the outcome of the H2 MOBILITY public-private joint venture, which is planning a total of 100 HRSs by 2019 and a further 300 by 2023 with the German government covering 50% of CAPEX requirements.

Even though the future of H2 mobility can be defined by a perfect storm of uncertainty, we will experience a growing focus on H2 mobility in the years to come as the need for zero-emission solutions, such as FCEV, becomes most evident. As stated in the articles, the deployment of FCEV is not without hurdles but examples like California show us that with the right set of actions, those can be overcome.

Go to article Part 1: The window of opportunity for hydrogen mobility

Go to article Part 2: The infrastructure holds the key

ISO/IEC 27001:2013 certified

ISO/IEC 27001:2013 certified