accilium perspective:

Established Automakers & Suppliers in Crisis – Declining sales and market share losses are presenting automakers like Volkswagen, BMW, and Mercedes with unprecedented hurdles. The concept of Software-Defined Vehicles (SDV) challenges traditional automotive development because former success factors don’t work any more. How this became a fundamental crisis for carmakers and what is needed to successfully navigate the transformation is part of this accilium perspective.

Why the Future of the Automotive Industry Is Being Decided Now

In recent years, a decline in sales and market share has been observed among established automakers. In key markets such as China and Europe, brands like Volkswagen, BMW, and Mercedes have seen significant losses. At the same time, new players in the electric vehicle (EV) market, such as Tesla and Chinese manufacturers like BYD, are continuously gaining market share.

- In 2023, BYD sold approximately 2.9 million EVs, becoming the world’s largest seller of battery electric vehicles (BEVs), compared to BMW’s 0.5 million BEVs as the top German OEM.1

- Among the top-selling BEV models globally, vehicles from Chinese and American manufacturers dominate.1

- In Germany, Volkswagen’s market share in BEVs and PHEVs was just over 13%.1

- Around one-third of all cars produced today are manufactured in China.2

- The passenger car sales of German OEMs in China dropped by nearly 24% from 2020 to 2023.3

The traditional automotive industry is therefore faced with the urgent task of radically rethinking its development and investment strategies to remain competitive globally. Success factors of the past no longer suffice.

Why the Success Factors of the Past No Longer Apply

For decades, certain success factors defined the global dominance of established automakers. These companies secured their position through technological leadership in combustion engines, exceptional product quality, and long-standing customer loyalty. However, in today’s increasingly digital and globalized world, many of these factors have lost relevance.

- Technological Leadership

Established automakers were known for their expertise in building combustion engines, earning a reputation for producing high-performance, efficient, and durable engines. However, the transition to electromobility has diminished the importance of combustion engines. Electric drives are rapidly gaining traction, with companies like Tesla and BYD leading the charge while traditional manufacturers lag behind. - Engineering Excellence

Engineering precision was once a core success factor, especially in the premium segment. While the quality of these vehicles remains high, the definition of “quality” has shifted. It now encompasses digital innovations, software, and services. Here, traditional manufacturers are at a disadvantage compared to companies like Tesla or Xpeng, which have achieved strong software integration in their vehicles. - Brand Loyalty

Established automakers historically benefited from extremely loyal customers. However, younger generations, particularly Millennials and Gen Z, prioritize technological innovation, user experience, and cost over brand loyalty. New players have demonstrated that it is possible to establish a brand in the automotive market and excite customers about new technologies within a short time.

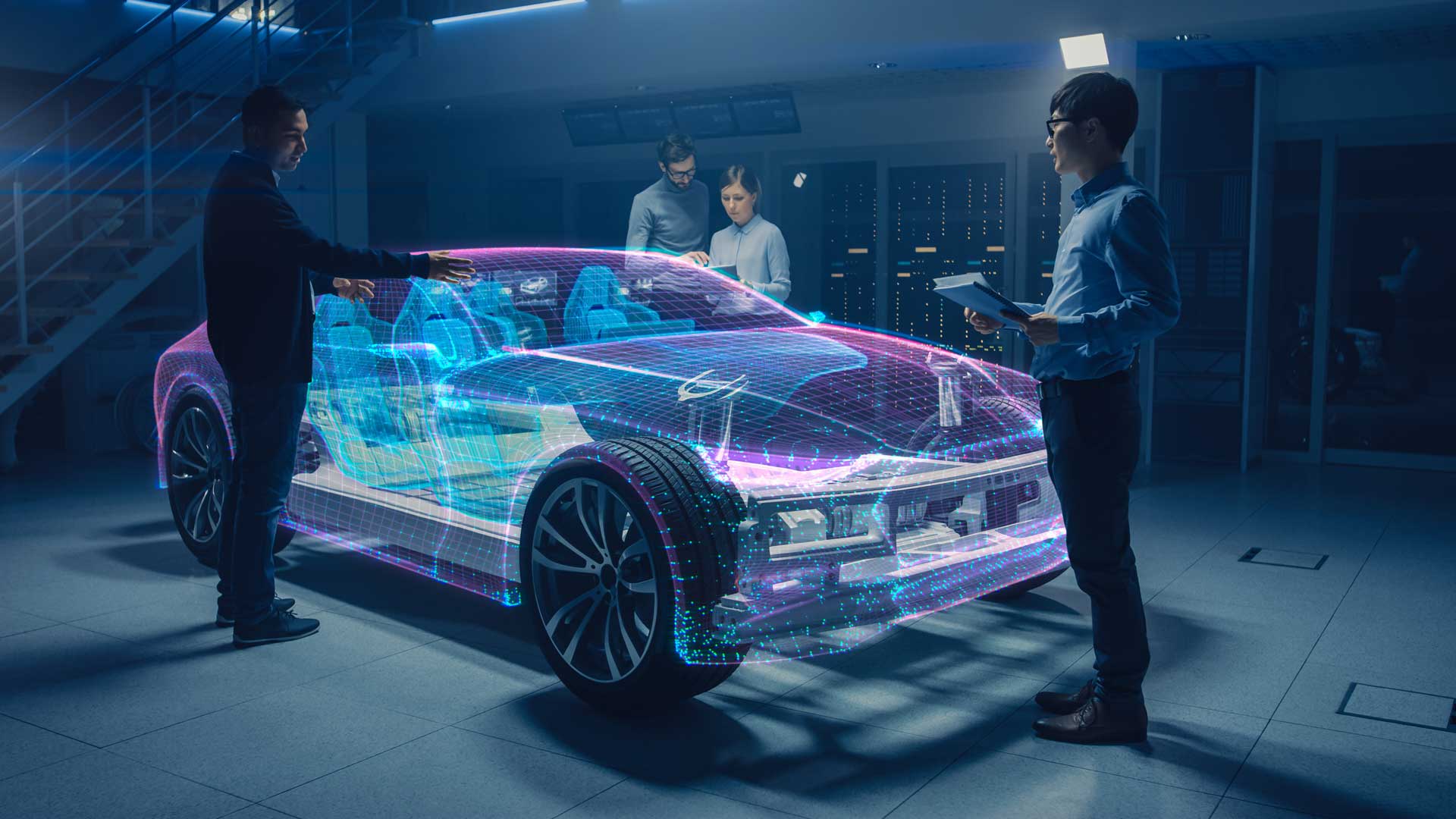

Why the Future Belongs to Software-Defined Vehicles

The ongoing transformation is deeply driven by digitalization. A key development in this context is the concept of the Software-Defined Vehicle (SDV). These vehicles rely on software as the driving force for nearly all functions, fundamentally distinguishing them from traditional hardware-focused cars. The SDV market is projected to reach $700 billion by 2034, with an average annual growth rate of 35% from 2023 to 2034. Successfully transitioning to SDVs will determine the future competitiveness of global automotive OEMs.

The transition to SDVs presents immense challenges for established OEMs. They face a lack of software expertise, historically complex organizational structures, and rigid, inflexible development processes. Achieving success in SDVs requires radical rethinking and approaches to quickly steer traditional players back on track.

How R&D Can Transform Toward SDVs

New players like Tesla have shown that developing an SDV from scratch is possible. For global corporations, however, this task is significantly more difficult, as established automakers have painfully realized in recent years. Our credo for a successful SDV transformation is “Project transforms legacy.” What does this mean in practice?

- Top-down R&D reorganizations toward SDVs have failed in recent years.

- Only through successful SDV projects can legacy R&D organizations be gradually transformed.

- Balancing SDV decoupling (for speed and innovation) and reintegrating proven solutions into the legacy environment is the most challenging task.

We detail how this balancing act can succeed in our approach, “How to Transform R&D with Successful SDV Projects.”

1 https://www.statista.com/study/49240/emobility—market-insights-and-data-analysis/

3 https://www.vda.de/de/themen/Automobil-Insight-2023/Wettbewerber-und-Partner-China-Strategie

Your Experts:

Johannes Florian

Associate Partner

Nora Kirsche

Associate Manager

Martin Schmitz

Associate Manager

ISO/IEC 27001:2013 certified

ISO/IEC 27001:2013 certified