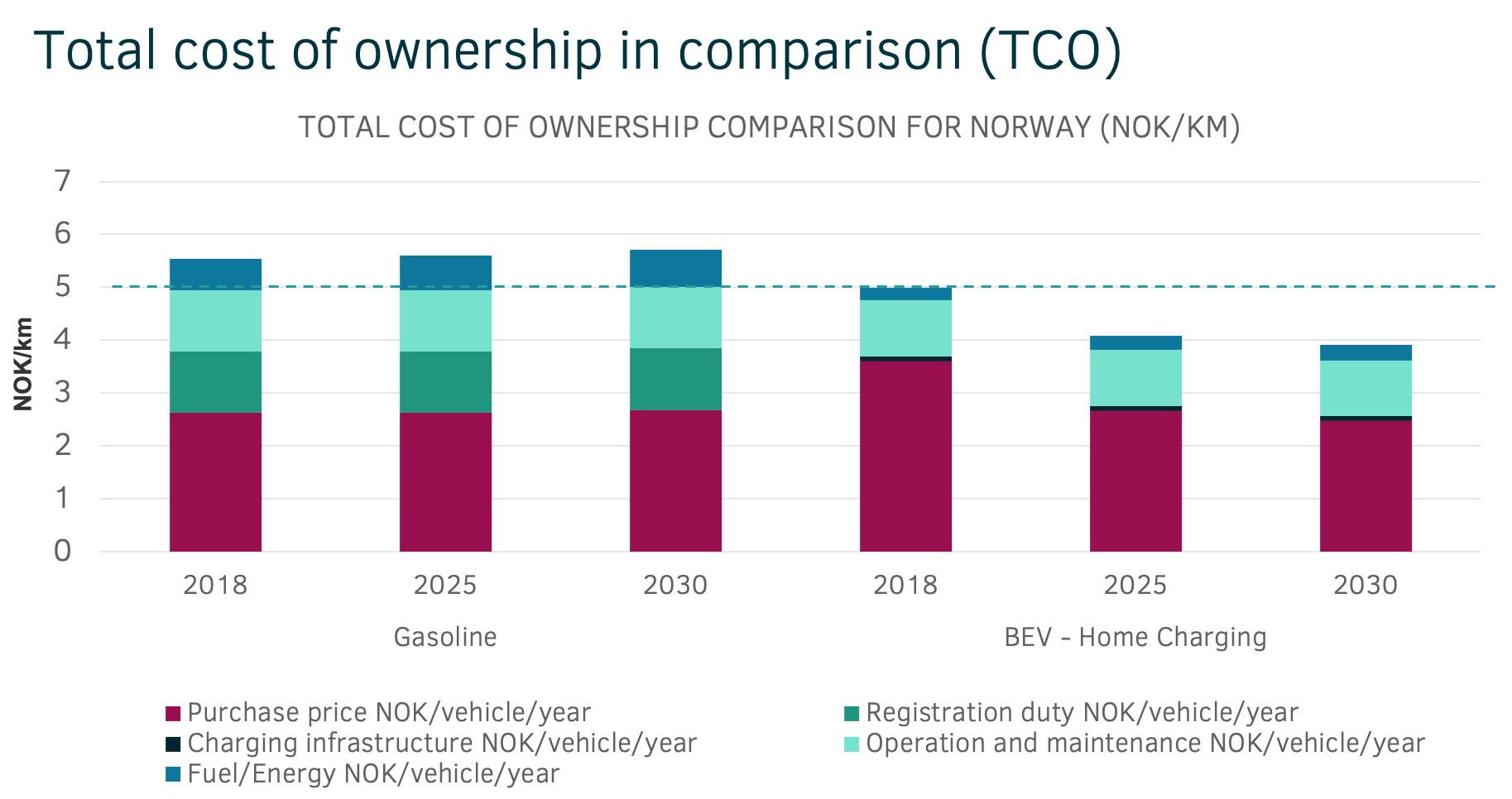

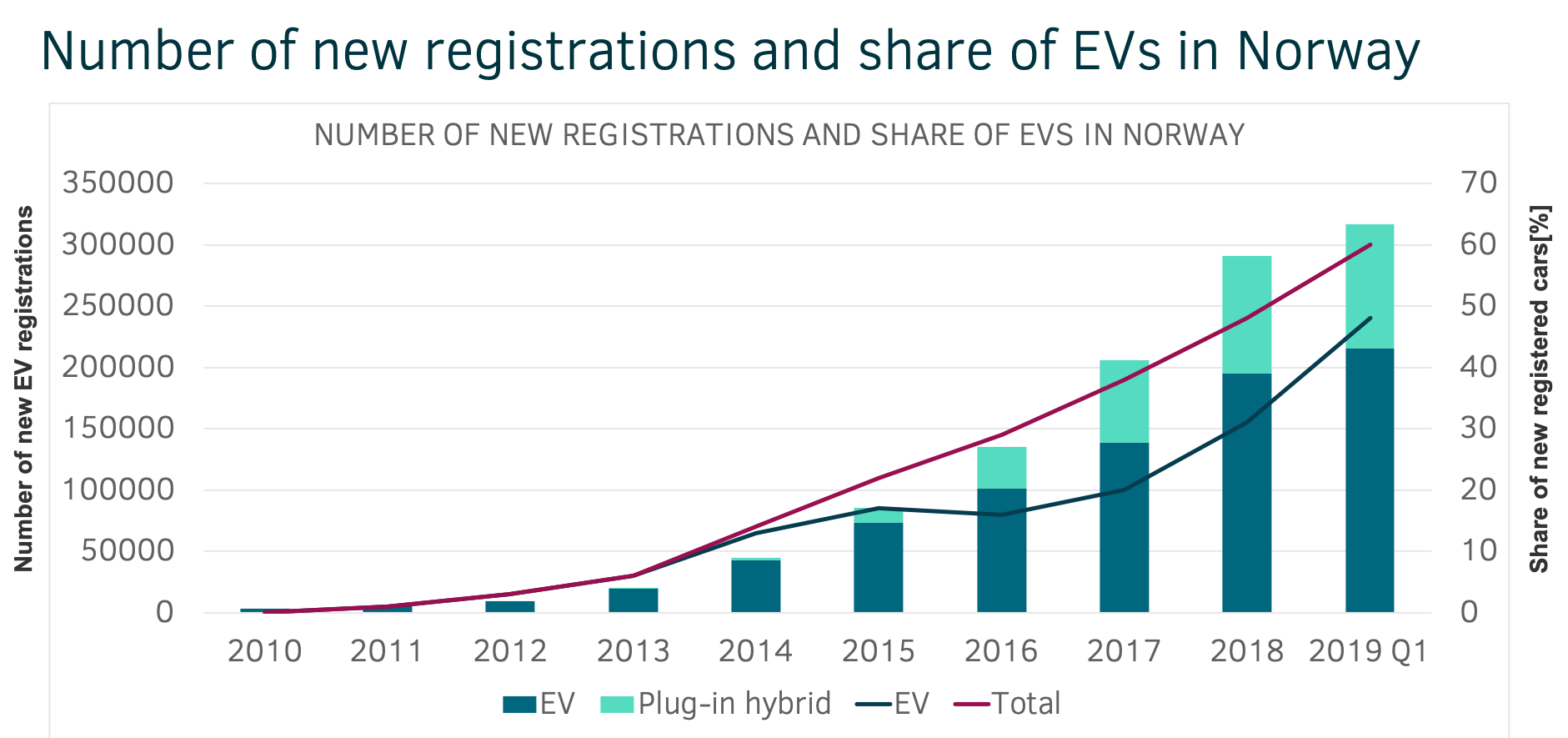

Norway is considered the forerunner in electric vehicle (EV) adoption by a long stretch. Last year, the sales of EVs and hybrids in Norway reached 50% of new cars, and in the first quarter this year it even reached 60%. Yet the EV revolution in Norway has not happened by itself – tax exemptions and several benefits (lower toll road costs, bus-lane driving and free parking in several municipalities) are important boosters for EV sales, resulting in lower total cost of ownership per kilometre than a comparable gasoline car.

Source: Total cost of ownership in comparison (TCO), DNV GL, 2019

The graph above illustrates our estimation of the total cost of ownership for a gasoline car and a battery electric vehicle (BEV) with home charging for 2018, as well as expectations for 2025 and 2030. The registration duty for a gasoline car, which BEVs are exempt from, leads to a widening TCO gap with a clear cost advantage for BEVs, resulting in a rapid increase in BEV sales, see below.

Source: Number of registrations and share of EVs, DNV GL, 2019

Download the slide deck “The Norway way”

The EV revolution – estimates for global sales of BEVs and global energy demand

With our best estimate for the global developments in demand and production of energy, we predict a very rapid uptake of light battery electric vehicles once they reach cost parity with internal combustion cars, which is expected to be within five years’ time. This uptake will then follow an S-curve pattern, associated with the speed of adoption of innovation, as battery technologies continue to improve over the next decades. Our prediction is, that by the mid-2030s, more than 50% of new light vehicle sales globally will be BEVs.

While major car manufacturers are speeding up their fleet electrification and expecting fast growing numbers in sales for BEV, the main underlying factor for the political interest in promoting electrification of transport is reducing local pollution and lowering greenhouse gas emissions. The EV revolution will lead to a significant increase in demand for electricity over the coming decades. Our expectation of global electricity needs for road transport is for it to grow from the negligible demand today to almost 10.000 TWh in 2050. This is about 18-times the total power generation of Germany or 180-times of Austria in 2018.

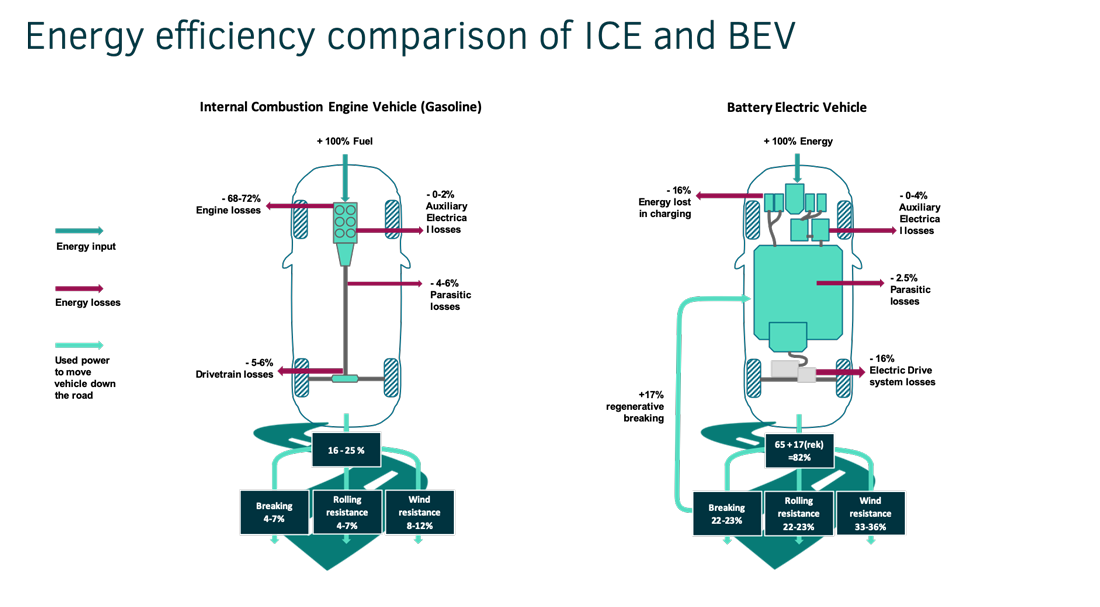

Such a momentum of growth in power demand is unprecedented, especially in a time where, at least in richer countries around the globe, we see electricity demand fall due to efficiency measures. Although the demand for electricity is set to rise substantially the total energy use by road transport will decline. Despite increasing numbers of vehicles, we predict that the energy demand in 2050 will be 90% of today’s level, as modern BEVs are more than three times more energy efficient than internal combustion engine vehicles. A comparison of energy efficiency can be seen in the picture below.

Source: Energy efficency comparison of ICE and BEV, Data by US Department of Energy; Graphical illustration by accilium, 2019

So the question is: Can electric grids handle such a massive increase in power demand?

The short answer is YES they can, but as is so often the case, the devil is in the detail.

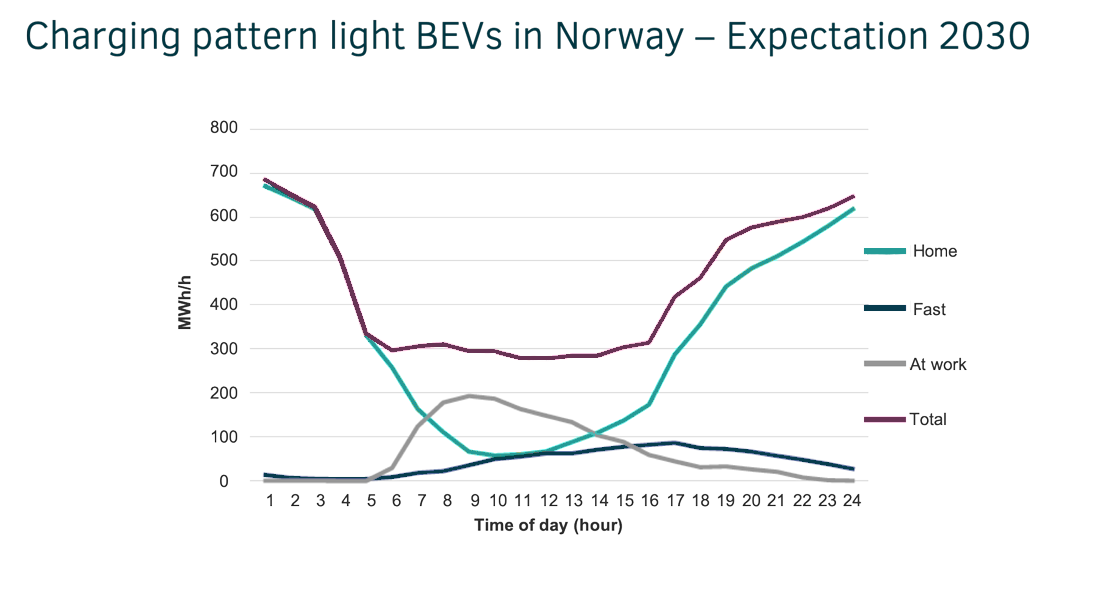

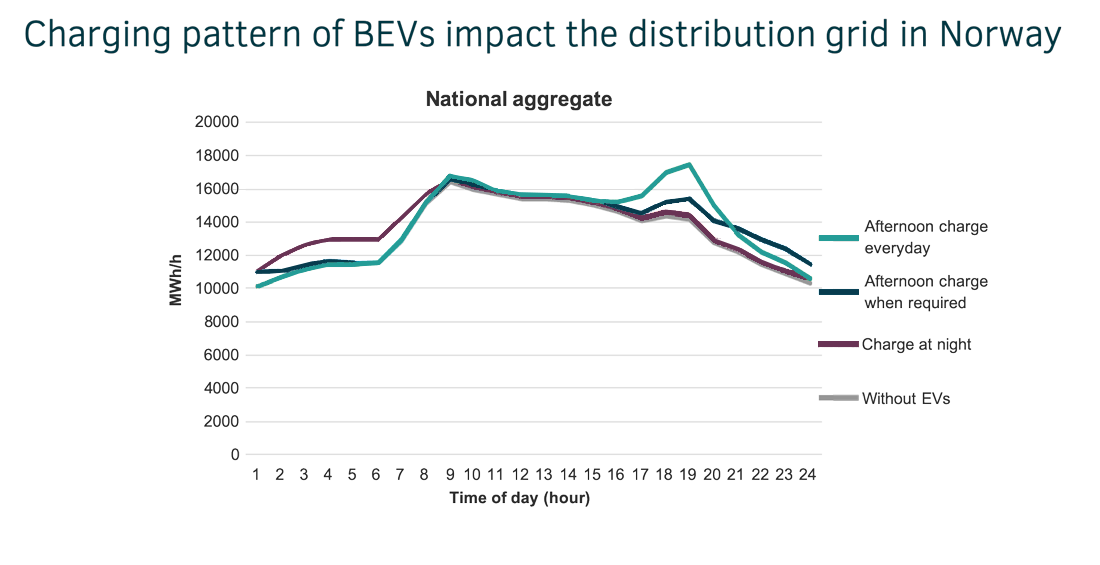

To explain this, we take a closer look at Norway again and at the national aggregate load in the distribution grid under different assumptions of load from BEVs in 2030.

The graph below shows a relatively small effect of EVs on the national aggregated load. This is caused by the fact that Norway is dominated by electrical heating. Thus, EVs do not dominate the load, but still give a visible impact, mainly depending on the charging patterns by EV owners.

Source: Charging pattern light BEVs in Norway – Expectation 2030, DNV GL, 2019 and NVE 2018; Charging pattern of BEVs impact the distribution grid in Norway, DNV GL, 2019

Download the slide deck “The Norway way”

What seems to be a small peak on the graph when BEV owners in 2030 charge their cars in the late afternoon each day, might result in additional investments for the distribution grid of up to 1 billion EUR by our calculations. However, if alternative charging patterns can be encouraged then significant reductions could be achieved in the potential investment. Charging only when required in the afternoon would result in approximately a 50% reduction and charging at night may require only a minimal investment in the grid.

Shifting the foreseeable BEV load into off-peak periods will not only alleviate the additional grid investments, it could be of great value for utilities and their customers, providing additional sales for utilities without adding additional stress to their grids, therefore helping to keep the cost per kWh for customers low. Proactive steps from utilities such as influencing customer behavior with real time pricing, could reward customers as they burden the system less. In addition, active charging management, using smart charging solutions will be increasingly deployed to control when the car is charged and how fast it is charging.

Sounds good – doesn´t it? But with electrification of trains, trucks, buses, ferries and lots of other vehicles, overwhelming load is still a potential threat to the grid which often, especially when a high number of vehicles are densely located, needs an individual look and localized investment.

Coming back to Norway, ferries are one of the drivers of such investments, but it could equally be fleet charging stations for buses, logistical hubs or BEV super charger stations in Northern America or Continental Europe.

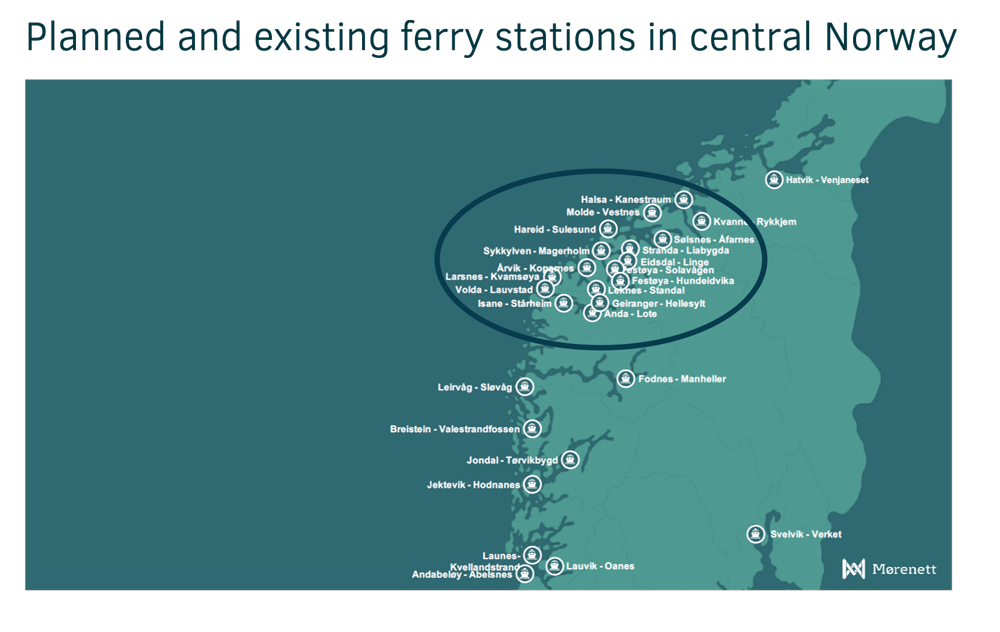

Source: Planned and existing ferry stations in central Norway, Mørenett, 2019

Lessons learned from “The Norway way” – Electrification of the mobility ecosystem

The picture above shows a Norwegian example, a string of 70 new electric ferries are planned to be put into operation over the next couple of years. Ferries stop only for a short period of time to have cars leaving and entering the vessel, and in the same time (often as short as 8 minutes) all the power must be transferred to the vessel. This high-power demand with peaks rapidly ramping up and down can be a challenge. Furthermore, typically the ferry quays are in sparsely populated areas and at the end of a weak grid connection. This represents clear system challenges and raises the question of how best to handle such peaks. Is grid reinforcement applicable to serve those peaks, or can a battery storage system at the quay solve the issue by reduced peak demand from the grid and enabling rapid, high-power charging to the ferry?

The answer to this complex challenge is not straight forward, as it is affected by grid regulations, the grid tariff structure, and what business model is applied for the battery ownership and management. However, so far a battery on the quay has been the dominating answer, and this again triggers a question on who should own and operate the batteries and charging infrastructure – not only at ferry quays, but wherever new high power demand is required and grids struggle to cater for it.

The industries are in a flux, looking for new business models and cross-industry relations. This can be seen not only in electrification of transport and charging infrastructure, but also when it comes to developments for future tariff and market design. In Norway power companies start to establish new ventures to own and operate assets for maritime and road transport charging. In Germany car manufacturers similarly build charging networks and even become electricity providers. Such patterns are growing rapidly. The rise of electric vehicles is impacting several stakeholders, including the public sector, utilities and car manufacturers; it is presenting challenges, opportunities and bringing them closer together.

DNV GL and accilium help to orchestrate those new and upcoming changes and provide individual and scalable solutions for such complex problems. Contact us now to find out, how your company can benefit from new opportunities within this fast-growing ecosystem.

ISO/IEC 27001:2013 certified

ISO/IEC 27001:2013 certified